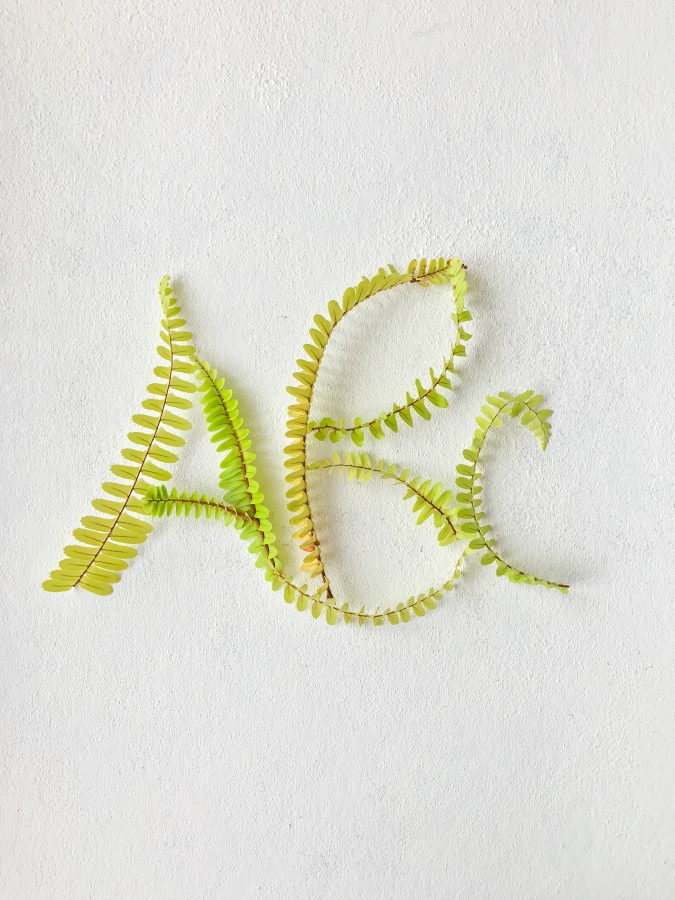

- Alimony Deduction, Auto for Business, or Annuity Investments

- Bonus Depreciation, Bunching Deductions

- Charity Contributions, Capital Gains/Losses, Childcare Credit

- Deductions and Dependents

- Education Credits

- Filing Status or Flexible Spending Account

- Gifts, Gambling Losses

- Health Savings Accounts or Home Offices

- Installment Sales and IRA Contributions

- Like Kind Exchanges

- Meals for Business, Medical Expenses, Military Moving

- Points, Property Taxes

- Qualified Business Deduction

- Retirement Contributions

- Student Loan Interest, Salaries and Pre-Tax Benefits

- Teacher Classroom Expenses, Travel for Business, Taxes

- Utilities for Business or Home Office

- Vacation Homes

- Work Uniforms

Call us at 727-810-8106 for more information on any or all of these